Learn More About Your Financial Journey

Download Today & Start Reading Instantly!

At MAH Financial Services we create a customized plan based on your own values and beliefs about money that reflects your own unique goals and priorities.

Below, we are offering complimentary downloads of some of our top financial insights to help you assess your current investment and retirement strategies. We hope you find these retirement and financial insight white papers helpful.

Ultimate 401(k) Guide

How to Take Control of Your 401(k) Before and After Retirement

The 401(k) is one of the most important retirement planning tools we have. You pay into it for decades and will likely rely on it, among other income sources, for decades in retirement. The potential tax benefits and power of compound returns can make it a great savings and investment tool for retirement. But to make the most of these accounts requires an informed strategy. There are several important things to know about your 401(k), such as how much you can contribute, options for your 401(k) when you leave your job, and how much you are paying in 401(k) fees.

The Ultimate 401(k) Guide | Healthcare Professionals

Taking Control of Your 401(k) as a Healthcare Professional

If you’re a healthcare professional, you’ve worked hard to earn your credentials, whether you are a nursing assistant, administrator, doctor, or any of the many other healthcare professions. You’ve invested time and money into your healthcare training and education, but now it’s time to think about investing in your future retirement by understanding and strategizing your 401(k)s and related retirement accounts.

Tax Planning Guide

Your Roadmap to Reduced Taxes This Year and in the Future

We believe it’s important that you look to employ tax diversity in your retirement plan. Different types of investments can impact your taxes differently. Having accounts that receive varying tax treatments is a key strategy. You should work with a qualified professional to help determine exactly how much you should have in each tax “bucket” to help minimize your overall tax burden in retirement.

While the tax code can be incredibly complex, you still need to stick to the basics when it comes to filing and preparing your tax returns. So, here are our 5 tips to help you better prepare for tax filing this year.

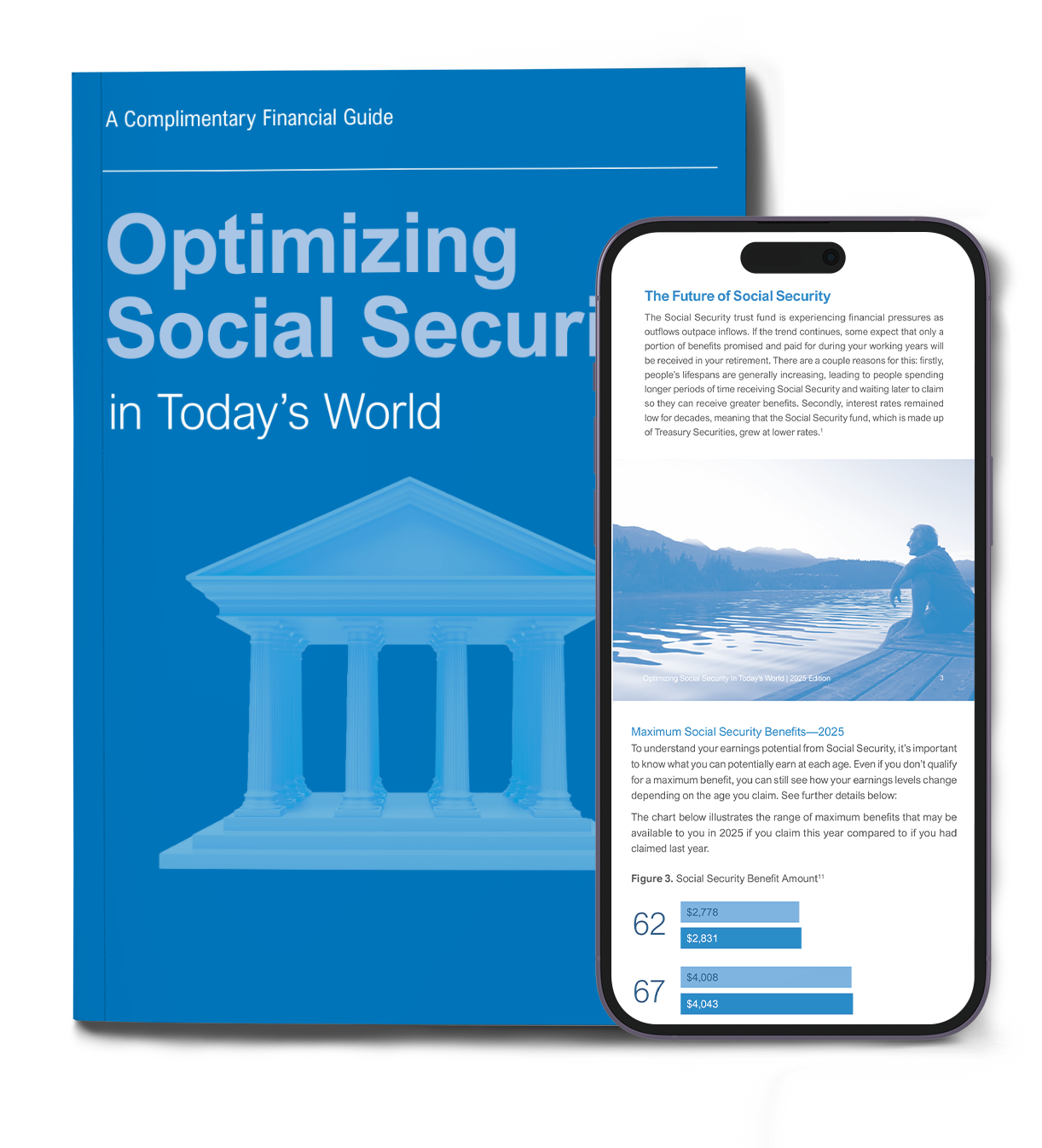

Social Security Guide

Optimizing Social Security In Today’s World

Social Security planning is one of the most important elements in any retirement plan, but getting the most from your Social Security benefit can also feel complex and frustrating. In our guide, Optimizing Your Social Security in Today’s World, you’ll uncover practical tips and easy-to-understand steps to get the most out of your Social Security benefits.

2025 Edition: Retirement & Inflation Guide

What To Know and How To Prepare

In 2024, we saw a continuation of market turbulence, loosening of labor markets, and lighter inflation due to economic tightening from the Federal Reserve, yet a signal that they’ll start decreasing interest rates. Compared to a couple of years ago, you may have noticed higher prices on the items you buy every week and may be wondering if we’ll continue to see high inflation. While inflation may be coming down, as long as it is positive, prices are rising.

Medicare & MediGap Guide

Navigating Medicare and Medigap

Unfortunately, the Medicare system can be quite complex. This leads too many retirees to overspend on healthcare expenses and receive suboptimal coverage over the span of their retirement. Don’t pay more than you should for the health services and coverage you deserve!

Interested In MAH Financial?

Browse Our Services To See How We Can Help!